Casino Win Loss Statement Taxes

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/gambling-56a239ca3df78cf772736f31.jpg)

Gamblers love to use casino win/loss statements because it is easy. Just report the amounts from the casino win/loss statements. No muss, no fuss. No record keeping hassles. You’re done.

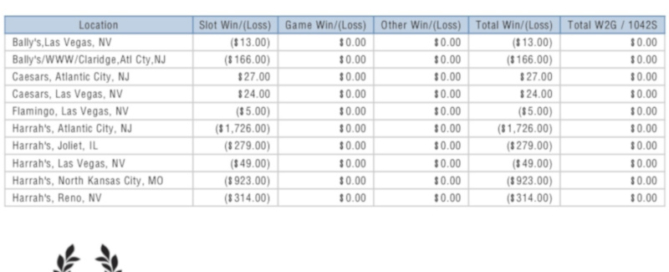

You’re allowed to deduct losses only up to the amount of the gambling income you claimed. So if you won $2000 but lost $5,000, your itemized deduction is limited to $2,000. You can’t use the remaining $3,000 to reduce your other taxable income. If you’re a professional gambler. Casinos offer a win-loss statement for their slot players that itemizes coin-in and coin-out, but vary in their player-tracking policies for other types of play. The casino will give you a copy of the gambling win, on Form W-2G and send a copy to the IRS.

Unfortunately, it doesn’t work that way.

- Win/Loss Statements will only be processed for the current tax year. All requests, whether received by mail or in person, will be processed starting January after that tax year. All requests that are mailed must have a copy of valid state issued picture ID. One request form per account number.

- Notably, the win-loss statements reflect that petitioners had gambling winnings totaling $115,142, while the Forms W–2G provide that petitioners had total gambling winnings of $322,500 In other words, Judge Wherry relied upon casino win/loss statements to impeach the credibility of the taxpayers’ other evidence.

- Before we explore strategies for deducting gambling losses we need to review the rules as they stand. Gambling Wins and Losses on a Tax Return. Gambling wins are reported on the front page of Form 1040 for tax years 2017 and prior. Gambling wins are reported on Schedule 1, Line 21 for tax year 2018.

For starters, the Internal Revenue Code requires taxpayers to keep and maintain adequate records sufficient to prove their income and deductions. In the opinion of the IRS and most courts, casino win/loss statements do not meet these record keeping requirements. And, it is possible, depending upon the facts and circumstances, that the IRS could assess penalties against the gambler that used such documents.

But it gets worse.

The methods the casinos use to calculate your wins and losses – contrary to the “gambling session” method recommended by the IRS – actually overstates these amounts. For example, if you start your IRS-approved gambling session with $100 and end with $125, then you only report $25 of gambling income – according to the IRS-approved “gambling session” method.

On the other hand, if you use your Player’s Card so the casino can track your play – it will. Every winning spin on the slot machine will be recorded, and every losing spin will be recorded. So, if you started with $100 and played for several hours, you could have $2,025 of reportable wins and $2,000 of reportable losses. The net difference is still only $25, but you have to report $2,000 more of income!

Now, comes the really bad part.

Often times the IRS will not challenge the amount of the wins, but they will disallow the gambling losses. So, in our example, the gambler will still be required to report $2,025 of gambling income, but will be prevented from deducting the $2,000 of offsetting gambling losses – the worst of all possibilities!

Casino Win Loss Statement Taxes

Gambling Win Loss Statement Taxes

Because of these problems, it is difficult to recommend that any gambler rely heavily on casino win/loss statements for reporting the amounts of their wagering gains and wagering losses on their income tax return.